Martin Kpebu

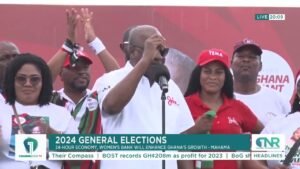

Bank of Ghana Governor Ernest Addison ruled out providing more loans to the government to help narrow the budget shortfall, saying it would put exchange-rate stability at risk.

The central bank shelved its zero-financing policy this year to lend the government 10 billion cedis ($1.7 billion) to help mitigate the impact of the coronavirus pandemic on the West African economy. Ghana’s budget deficit is projected to reach 11.4% of gross domestic product by the end of December, against an initial target of 4.7% of GDP.

“The wide fiscal gap raises important financing issues,” Addison said in a speech late Thursday, in the capital, Accra. “Its financing should not be by recourse to central bank funds, as this will weaken the central bank’s ability to serve as the anchor of monetary- and exchange-rate stability.”

The cedi has had its most stable spell in more than a decade this year, weakening 2.6% to the U.S. dollar. That’s even as the global health crisis drove Ghana’s ratio of debt to gross domestic product to 71% in September, the highest in four years.

“Going forward, difficult decisions will have to be taken to reorganize public finances and expenditure priorities, while exploring more sustainable revenue sources,” Addison said.